Trade Effects

In the SMART modeling framework, a change in trade policy (say preferential tariff liberalization) affects not only the price index/level of the composite good but also the relative prices of the different varieties. Though the export supply elasticity, the import demand elasticity, and the substitution elasticity, it will lead to changes in the chosen aggregate level of spending on that good, as well as, changes in the composition of the sourcing of that good. Both channels affect bilateral trade flows.

SMART reports the results of any trade policy shock on a number of variables. In particular, it reports the effects on trade flows (i.e., imports from the different sources). It also decomposes those trade effects in trade creation and trade diversion. Trade creation is defined as the direct increase in imports following a reduction on the tariff imposed on good g from country C. If the tariff reduction on good g from country C is a preferential tariff reduction (i.e., it does not apply to other countries), then imports of good g from country C are further going to increase due to the substitution away from imports of good g from other countries that becomes relatively more expensive. This is the definition of trade diversion in the SMART model.

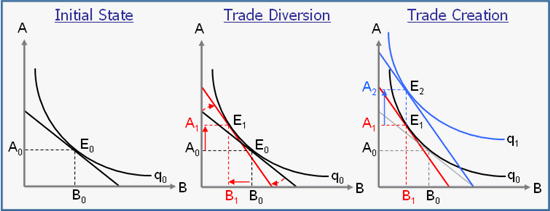

The graphics below illustrates the trade diversion and creation effects. A and B are two partner countries which the considered market imports good g from. Consumed composite quantity q0 is imported from A and B. The quantity respectively imported from A (A0) and B (B0) is given by E0, the intersection between q0 and the line depicting the relative price between the two varieties.

Trade diversion effect: granting partner A a preferential tariff reduces its relative price compared with B. Consumption of the composite good is unchanged but the relative price line gets steeper. It leads to a new equilibrium (E1) where imports from A increases (from A0 to A1) while imports from B symmetrically decreases (from B0 to B1). This is the trade diversion effect as calculated in SMART.

Trade creation effect: reducing the tariff on imports from partner A lowers the domestic price of the variety coming from A. It entails a revenue effect which allows reaching a higher composite quantity curve q1. For the same expenditure level, consumers can now import more of the variety coming from A (A1 to A2).

On the market side, trade diversion is neutral. It does not affect the overall imported quantity but reallocates market shares among exporting partners based on the new relative prices. The increase in imports from tariff reduction beneficiaries is balanced by a decrease in imports from all others. For the market, the trade effect is only trade creation.

For exporting countries, total trade effect is made of trade diversion and trade creation. In SMART, beneficiaries of the tariff reduction enjoy both positive diversion effect (A0 to A1) and positive creation effect (A1 to A2) while all other partners will suffer from negative diversion effect (B0 to B1) and no trade creation effect (no B2 on the graphics).

Price Effect: This is a third component reported in the Trade Total effect and occurs only with a finite export supply elasticity assumption. It reflects the rise in world price for the good which demand increases following the tariff reduction (also known as the “terms of trade effect?). While trade creation and trade diversion effects depict impact on quantity, the price effect represents the additional import value from increased world price.

Next: Effects on Tariff Revenue, Consumer Surplus and Welfare

WITS Online Help

The World Bank, 2010